Analytica House

Sep 4, 2022What is RFM Analysis?

What is the most valuable asset for a company? Its tangible assets or inventory? Given developments in supply chains and the level of financial solutions, if you’re especially an e-commerce business, your most valuable asset is your customers.

Beyond your sales, when planning your inventory levels, ad investments, and many operational activities, you must consider the future behavior of your customers.

In today’s age of increasing digitalization and personalization, getting to know your customers is easier thanks to big data—but it also becomes more challenging as customer volume and diversity grow.

In this article, we’ll discuss RFM analysis, one of the fundamental analyses you can use to segment your customers and build effective audiences.

What Is RFM Analysis?

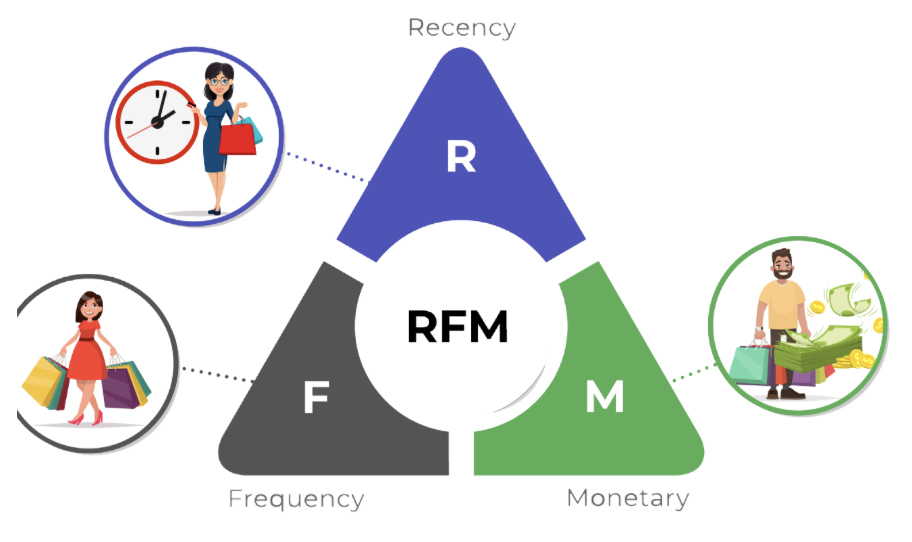

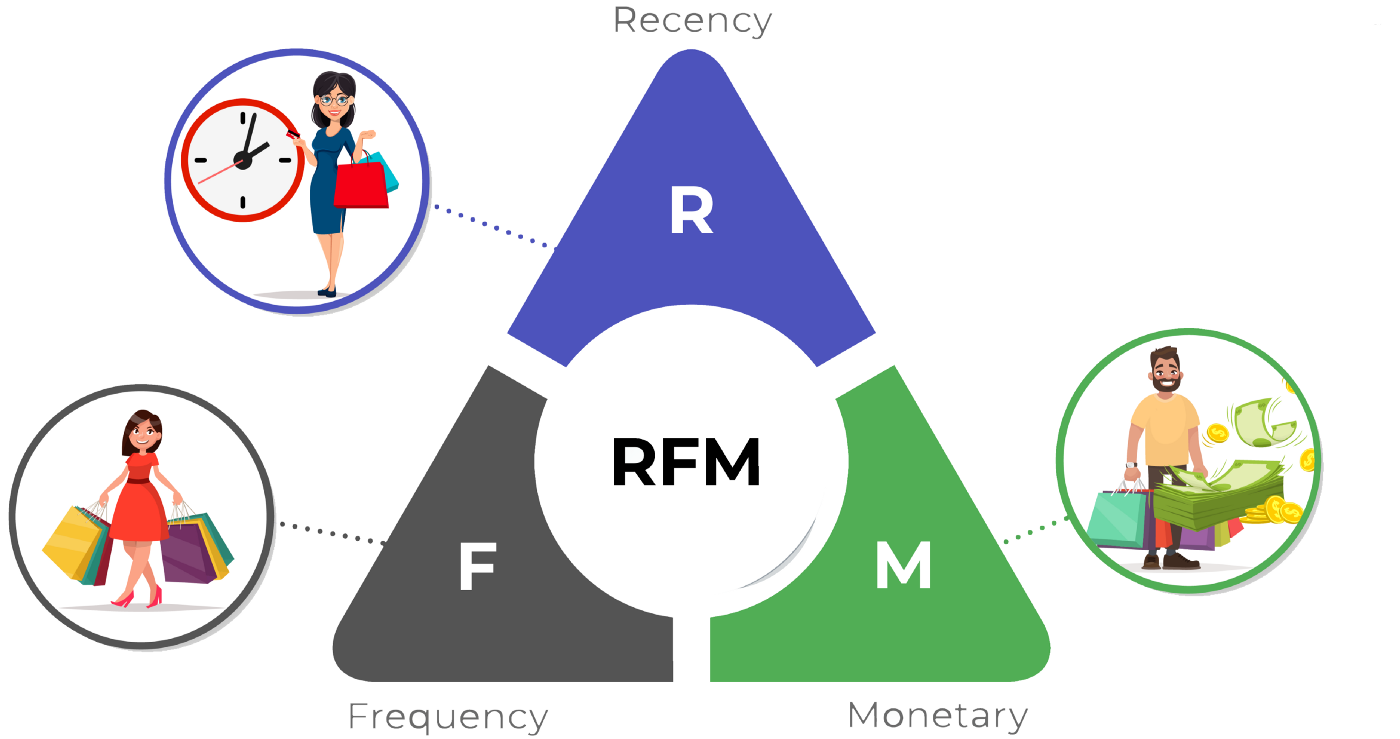

RFM analysis segments customers based on purchase data. As an algorithm, it uses unsupervised clustering (K-means). The “RFM” acronym stands for three key metrics. First, let’s look at what each metric means.

Recency

Calculated by the number of days between the analysis reference date and the customer’s most recent purchase date.

Frequency

The number of purchases the customer made in the analysis period. If many customers purchased only once—skewing the distribution—you may treat one-time buyers separately for a healthier analysis.

Monetary

The total monetary value of the customer’s purchases in the analysis period. Two considerations: 1) If purchases are in multiple currencies, convert them to a single currency. 2) If you have B2B wholesale orders, exclude them so they don’t skew the distribution.

What Questions Can RFM Analysis Answer?

Although RFM is purchase-behavior–based, it can answer many strategic questions about both new and existing customers, for example:

- Who are our most valuable customers?

- Which customers are at risk of churn?

- Which customers deserve retention efforts?

- Which customers share similar behavior for targeted campaigns?

Why Is RFM Analysis Important?

As every marketer knows, retaining existing customers is far cheaper than acquiring new ones. By using RFM to gauge how close customers are to conversion or churn, you can both retain at-risk customers and encourage more spending among active customers. You can also classify newly acquired customers into existing RFM segments to start personalized marketing before you’ve collected much new data.

Required Data Structure

RFM relies on transaction data—either CRM order logs or analytics platform transaction exports. For robust results, use at least one year (ideally two) of data. You need these columns:

- Unique customer identifier (user_id)

- Transaction date

- Order ID

- Transaction amount

Then compute per-customer Recency, Frequency, and Monetary values in your database or analytics tool.

Segmenting and Labeling Audiences

Cluster customers into, say, four groups by each R, F, and M metric. Then combine their cluster labels. For example:

Customers with high Frequency and high Recency are “Champions,” while high Frequency but low Recency might be “At Risk” or “Can’t Lose Them.” You can send “We miss you” coupons to at-risk groups, and premium product offers to Champions.

Sum the R, F, and M cluster scores to get an overall customer score, then bucket into “Platinum,” “Gold,” “Silver,” etc. Use these segments to allocate ad budgets more effectively.

At its core, RFM groups similar shoppers so you can optimize marketing spend, guide retention, and forecast sales.

Additional Metrics to Consider

You can extend RFM with:

- Duration/Engagement: session time or pages per session

- Tenure: days since first purchase

- Churn Risk: predicted probability of churn

Adding these refines your segments and deepens insights.

Next Steps

Once segments are defined, analyze demographic, geographic, and behavioral patterns within each. Then:

- Map new customers to existing segments for immediate targeting.

- Run category- or product-level RFM to create niche micro-segments.

- Apply attribution models to understand each segment's purchase journey and optimize touchpoints.

RFM analysis offers actionable insights from simple transaction data—use it to refine marketing strategies, reclaim at-risk customers, and boost customer lifetime value.

If you found this post useful, please share it on social media so others can benefit!

References

- https://en.wikipedia.org/wiki/RFM_(market_research)

- https://www.investopedia.com/terms/r/rfm-recency-frequency-monetary-value.asp

- https://iopscience.iop.org/article/10.1088/1742-6596/1869/1/012085/pdf

More resources

Generative Engine Optimization (GEO) in the Financial Sector: YMYL Risks and Trust Signals

With the integration of artificial intelligence technologies into the search engine ecosystem, the t...

B2B SaaS Generative Engine Optimization (GEO): A Content and Measurement Model That Increases Demo Requests

The digital marketing world is undergoing a major evolution from traditional search engine optimizat...

What Is a Source Term Vector?

A Source Term Vector is a conceptual expertise profile that shows which topics a website is associat...