With the integration of artificial intelligence technologies into the search engine ecosystem, the traditional concept of SEO (Search Engine Optimization) is being replaced by a more complex and dynamic process called GEO (Generative Engine Optimization). In particular, Generative Engine Optimization (GEO) strategies in the Financial Sector carry vital importance for content in the Your Money Your Life (YMYL) category, which directly affects users’ financial well-being and future. The perception of content produced in areas such as financial advisory, investment instruments, banking services, and insurance as a reliable source by generative AI models (LLMs) has become a decisive criterion for brands’ digital visibility. In this new era, it is no longer sufficient to adopt only a keyword-focused approach; instead, the accuracy of information, the authority of the source, and the perfection of technical configuration come to the forefront.

Trust is the foundation of everything in the world of finance. Users want to be sure of the accuracy of the information they encounter when making an investment decision or applying for a loan. Systems such as Google SGE (Search Generative Experience), Perplexity, and OpenAI’s SearchGPT look for certain signals in content to establish this trust. Generative Engine Optimization (GEO) strategies in the Financial Sector aim to understand how these systems analyze content and to create data architectures aligned with these analysis processes. In addition to traditional ranking factors, elements such as increasing the number of citations, transparently presenting statistical data, and including expert opinions in the content are cornerstones that strengthen the reputation of financial brands in the eyes of AI engines.

Generative Engine Optimization (GEO) Strategies in the Financial Sector and the Relationship with YMYL

YMYL (Your Money or Your Life) is the strictest evaluation standard that search engines apply to content that may affect a user’s health, financial stability, or safety. While developing Generative Engine Optimization (GEO) strategies in the Financial Sector, minimizing YMYL risks is a necessity. AI engines turn to the most reliable data sources to minimize the risk of making mistakes (hallucinating) when providing financial advice or summarizing a market analysis. At this point, it is not enough for your financial content to be merely correct; it must also be verifiable by independent and authoritative sources. If a piece of content contains ambiguities that could lead the user to an incorrect investment decision, generative engines will avoid referencing that content.

In financial content evaluated under YMYL, the following elements play a critical role in gaining the trust of AI models:

- Data Accuracy: Interest rates, market data, and legal regulations shared in the content must be up-to-date and precise.

- Source Attribution: Every financial claim made must be grounded in official institutions (Central Bank, CMB, BRSA, etc.).

- Author Authority: The writer’s competence in finance, academic background, or professional certifications must be clearly stated.

- Transparency: Users must be given honest information about the risks of financial products and potential losses.

In this context, Generative Engine Optimization (GEO) strategies in the Financial Sector transform the content production process into an information verification operation. Because AI prefers the least risky option when processing complex financial data, the logical consistency and reference depth of the information you present in your content are primary factors that directly affect your visibility.

The Impact of EEAT Criteria on Generative Engine Optimization (GEO) Strategies in the Financial Sector

Google’s EEAT (Experience, Expertise, Authoritativeness, Trustworthiness) guidelines gain an even deeper meaning in the GEO world. While implementing Generative Engine Optimization (GEO) strategies in the Financial Sector, EEAT signals must be presented in a machine-readable format for generative AI to accept a piece of content as an authority. In particular, the Trustworthiness element is central to ensuring user security in financial transactions. A bank’s or brokerage firm’s website should reinforce this trust with legal texts, license numbers, and clear contact information that prove it stands behind the information it provides to users.

The table below summarizes the counterpart of EEAT components in GEO processes and sector-specific application methods for finance:

| EEAT Component | Financial Sector Application | GEO Optimization Signal |

| Experience | User stories and real financial case studies. | First-person narratives and lived-experience data. |

| Expertise | Reports prepared by financial analysts and economists. | Academic and professional titles included in author bios. |

| Authoritativeness | Backlinks from industry news sites and academic journals. | The brand being mentioned in prestigious financial directories and news. |

| Trustworthiness | SSL certificates, transparent fee policy, and license information. | Secure payment infrastructure and the authenticity of user reviews. |

Each of these components must be handled meticulously within Generative Engine Optimization (GEO) strategies in the Financial Sector. AI scans multiple sources when explaining a topic and presents the user by combining the parts it finds most trustworthy. If your financial content does not meet these four criteria, it becomes almost impossible for your brand to appear in AI answers (AI snapshots). Especially authoritativeness and trustworthiness are the metrics that financial algorithms weigh most heavily.

Technical GEO Practices: Generative Engine Optimization (GEO) Strategies in the Financial Sector and Data Structuring

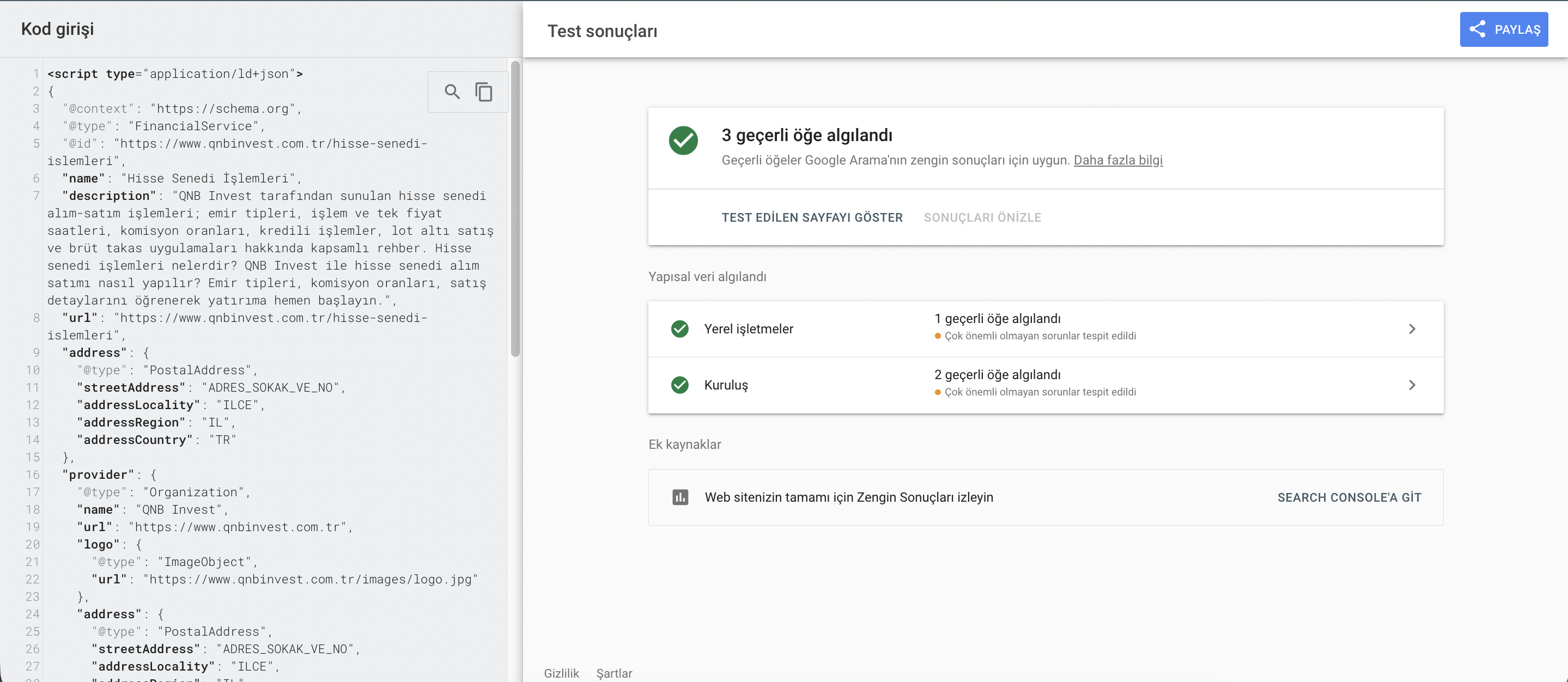

GEO is not only about writing content; it is also about how easily that content can be understood by AI. Within Generative Engine Optimization (GEO) strategies in the Financial Sector, the technical infrastructure should be strengthened through the use of structured data (Schema Markup). LLMs may sometimes miss context while analyzing raw text. However, structured data presented in JSON-LD format enables bots to understand flawlessly what the content is about, who wrote it, and which financial data it contains.

Critical technical optimization steps for financial websites are as follows:

- FinancialProduct Schema: Clarifying product features (interest rate, maturity, fees) by using special schema tags for loans, deposit accounts, or investment instruments.

- Organization Schema: Presenting the institution’s official name, logo, social media profiles, and contact information in a hierarchical structure.

- Person Schema: Adding tags that define content authors’ areas of expertise and digital footprints.

- FAQ Schema: Ensuring that clear and direct answers to financial questions can be used directly by AI in position zero results.

Thanks to structured data, Generative Engine Optimization (GEO) strategies in the Financial Sector produce more measurable and effective results. AI engines prefer data to be presented in a table or with specific tags while reading a complex stock market analysis. This creates the perception that the information is verified. In this process where Technical SEO evolves into GEO, the cleanliness of the code structure and the semantic relationships of the data are the key to ranking at the top in search results.

Content Strategies: Generative Engine Optimization (GEO) Strategies in the Financial Sector and Citation Power

Generative AI models prioritize the most cited and most frequently verified information when producing an answer. Therefore, while forming Generative Engine Optimization (GEO) strategies in the Financial Sector, content must be citation-worthy. Original research, industry surveys, unique market commentary, and infographics increase the likelihood that other sites and AI models will cite your content. When a financial brand becomes a primary source in its field, GEO success comes naturally.

To increase citation power and the rate at which your content is preferred by AI, you can follow these methods:

- Use of Statistical Data: Use concrete and statistical data such as “a 15% increase according to 2023 data” instead of abstract statements.

- Expert Opinions: Reinforce authority by adding quotations from well-known figures in the sector.

- Clear and Concise Answers: For questions like “How can a credit score be improved?”, provide a very clear summary of 2–3 sentences at the beginning of the article.

- Semantic Word Groups: Include not only the main keyword but also related secondary concepts that are semantically connected to financial terms.

Modern Generative Engine Optimization (GEO) strategies in the Financial Sector require compiling information with the meticulousness of a librarian. AI models scan thousands of pages of data in seconds to present the most refined information to the user. When your content becomes the source of that refined information, you not only gain a link click, but you also enable your brand to be labeled by AI as a reliable financial guide.

Future Financial Searches and Generative Engine Optimization (GEO) Strategies

In the future, search habits will evolve from typing keywords to engaging in dialogue with AI. Instead of searching for “the best mortgage loan,” users will ask complex questions such as “Which bank is the most suitable for me to get a 2 million TL loan with a monthly installment of 20,000 TL?” In order to respond to this new user behavior, Generative Engine Optimization (GEO) strategies in the Financial Sector should go beyond long-tail keywords and focus on intent-based optimization.

As a result, Generative Engine Optimization (GEO) strategies in the Financial Sector are not an option, but a necessity for the continuity of digital presence. Financial institutions that balance YMYL risks with professional EEAT management, strengthen their technical infrastructure with schema structures, and increase citation quality in their content will be the winners of the AI era. Progressing without compromising the principles of transparency, accuracy, and authority in this process will ensure lasting success both in the eyes of search engine algorithms and real users. By working with an expert

Generative Engine Optimization agency, you can also reach your goals.