Fatma Betül Koç

Oct 27, 2025TikTok and Comparison Sites in the Financial Sector

Opportunities offered by alternative channels in the finance sector are increasing. Thanks to innovative tools such as TikTok and comparison websites, financial institutions can now reach audiences faster and more effectively. This article will examine in detail the rise, advantages, challenges, and comparison of these two channels.

The Increasing Role of Alternative Channels in the Financial Sector

Traditional financial distribution networks (branches, phone banking, ATMs) have long been the backbone of the sector. However, digitalization, the widespread use of mobile devices, and social media platforms becoming central to daily life have increased the importance of alternative channels in providing financial services. Today, banks, insurance companies, fintechs, and credit institutions are actively using digital channels, going beyond physical interaction. This transformation particularly reduces dependence on traditional banking among younger user segments.

Alternative channels have become important not only in terms of distribution but also for data collection, customer engagement, and efficient use of marketing budgets. For example, financial service providers can now collect user behavior data from social media platforms, in-app movements, and comparison sites to create personalized offers, scoring models, and segmentation strategies. In overseas markets, alternative distribution models (such as mobile money or e-wallet devices) have also increased banking access and supported financial inclusion.

TikTok’s Role and Applications in the Financial Sector

TikTok, initially known for entertainment, comedy, and short video content, has attracted the attention of the financial sector through its advertising and sponsorship opportunities for creators and brands. When used strategically, TikTok can be a powerful channel for brand promotion, financial education content, and campaign announcements. Especially short and visually focused narratives (such as “How to apply for a loan in 5 steps” or “How to calculate an interest rate?”) are widely shared on TikTok.

Success on TikTok heavily depends on engagement (comments, likes, shares). The algorithm promotes content based on user behavior. Therefore, financial institutions must balance “educational + entertaining + attention-grabbing” components in their content strategies. For example, a bank might launch a “financial literacy mini tips” series or share a short story explaining a credit card campaign. This approach boosts brand awareness and attracts potential customers.

The Future of TikTok in the Financial Industry

TikTok’s role in the financial sector is expected to grow even further in the future. Younger generations increasingly use the platform to learn about financial topics, which drives more financial content creation. In the future, TikTok is expected to collaborate with financial service providers to deliver more professional and informative content. Financial institutions will use TikTok as a marketing tool to engage and interact with younger audiences.

Additionally, TikTok’s algorithm highlights content based on user interests, allowing financial content to reach broader audiences. It is expected that the platform will become more specialized in financial education and develop projects that promote financial literacy. With the ongoing digital transformation in the financial industry, TikTok’s role will become increasingly significant.

The Importance of Comparison Websites in Financial Services

Comparison websites (for example, platforms that compare loan, insurance, or deposit rates) allow users to view various financial offers in one place. This structure increases transparency, speeds up decision-making, and intensifies competition among institutions. Their revenue models often rely on referral commissions, ad placements, or fixed monthly fees.

These platforms provide financial institutions with a direct opportunity to showcase their products to targeted audiences while saving users time and effort. For example, instead of checking each bank’s loan offers individually, a user can visit a comparison site to see different interest rates, payment terms, and total repayment amounts within minutes. This enhances customer experience and helps institutions capture more segmented conversion opportunities.

TikTok or Comparison Sites? A Pros–Cons Analysis

Although both channels offer different advantages, the choice depends on goals, user behavior, and budget. The following table summarizes some key differences:

Criterion

TikTok

Comparison Website

Reach & Brand Visibility

Direct access to younger audiences, viral content potential

Ability to attract users actively searching for financial products

User Intent

Educational / awareness-driven, conversions take longer

Captures users at the decision-making stage

Cost

Requires video production, creative content, and ad budget

Commission per referral or fixed monthly fee

Data & Analytics Capability

Access to content interaction data (views, engagement rate)

Clear metrics for clicks, referrals, and offer comparisons

The ideal strategy for TikTok is to constantly test content, follow trends, and adapt based on user feedback. For comparison sites, institutions should structure their product offerings in an easy-to-analyze way, present offers clearly, and build user trust through testimonials and reviews.

Tips and Strategies for Adapting to Alternative Channels

Success in alternative channels depends on strengthening technical infrastructure, optimizing content strategy, and accurately tracking conversion metrics. Institutions can enhance engagement through short, visual TikTok videos and clear comparison tables or user reviews on comparison sites. For better results, it is crucial to ensure channel integration—directing users from one channel to another. The key steps to follow are:

Strengthen technical infrastructure (API connections, open banking compliance, security)

Optimize content strategy (TikTok videos, comparison tables, and user reviews)

Track KPIs and performance analytics (views, engagement, conversions, A/B tests)

Ensure channel integration (link redirections between TikTok and comparison sites)

The Evolution of Alternative Channels in the Financial World

Alternative channels in the financial industry are not temporary trends but permanent elements of transformation. With the continued rise of fintechs and digital trends, platforms like TikTok, comparison site ecosystems, and even AI-powered chatbots are expected to play an increasing role in offering financial services. According to the World Economic Forum, fintech growth currently maintains a steady annual rate of 37%. (World Economic Forum) Moreover, financial institutions are likely to enhance credit assessment and risk models through alternative data sources such as social media and mobile behavior data. (Deloitte Italia)

In Turkey, it is also expected that regulatory authorities will issue new fintech guidelines, support the industry, and clarify compliance processes for platforms like TikTok under data protection laws. For instance, the Turkey Fintech Guide was published in 2023. (Gokce Attorney Partnership) Institutions should increase investments in infrastructure, data analytics, and multichannel integration to prepare for the future—since in the financial sector, the concept of “alternative channels” may soon become “mandatory channels.”

Frequently Asked Questions

Why should FinTechs use social media platforms like TikTok?

TikTok provides direct access to young audiences and enhances brand awareness. Through short videos, complex financial topics can be explained in a simple and memorable way.

How can more conversions be achieved through comparison sites?

Ensuring offers are clearly presented, transparently displaying interest and cost details, including user reviews, and emphasizing the institution’s credibility increase conversions. Additionally, post-click application processes should be designed to be fast and user-friendly.

How can TikTok and comparison sites be used together?

Videos on TikTok can include prompts such as “Find detailed comparisons at this link,” while comparison sites can feature sections like “See how we showcased this product on TikTok.” This approach boosts cross-channel interaction and engagement.

Why are comparison sites important?

Comparison sites help users find the most suitable financial products and contribute to improving financial literacy. They enable users to make informed decisions.

Meta Description: Discover opportunities in financial services through TikTok and comparison sites. Read now to explore how digital channels enable fast and effective access.

More resources

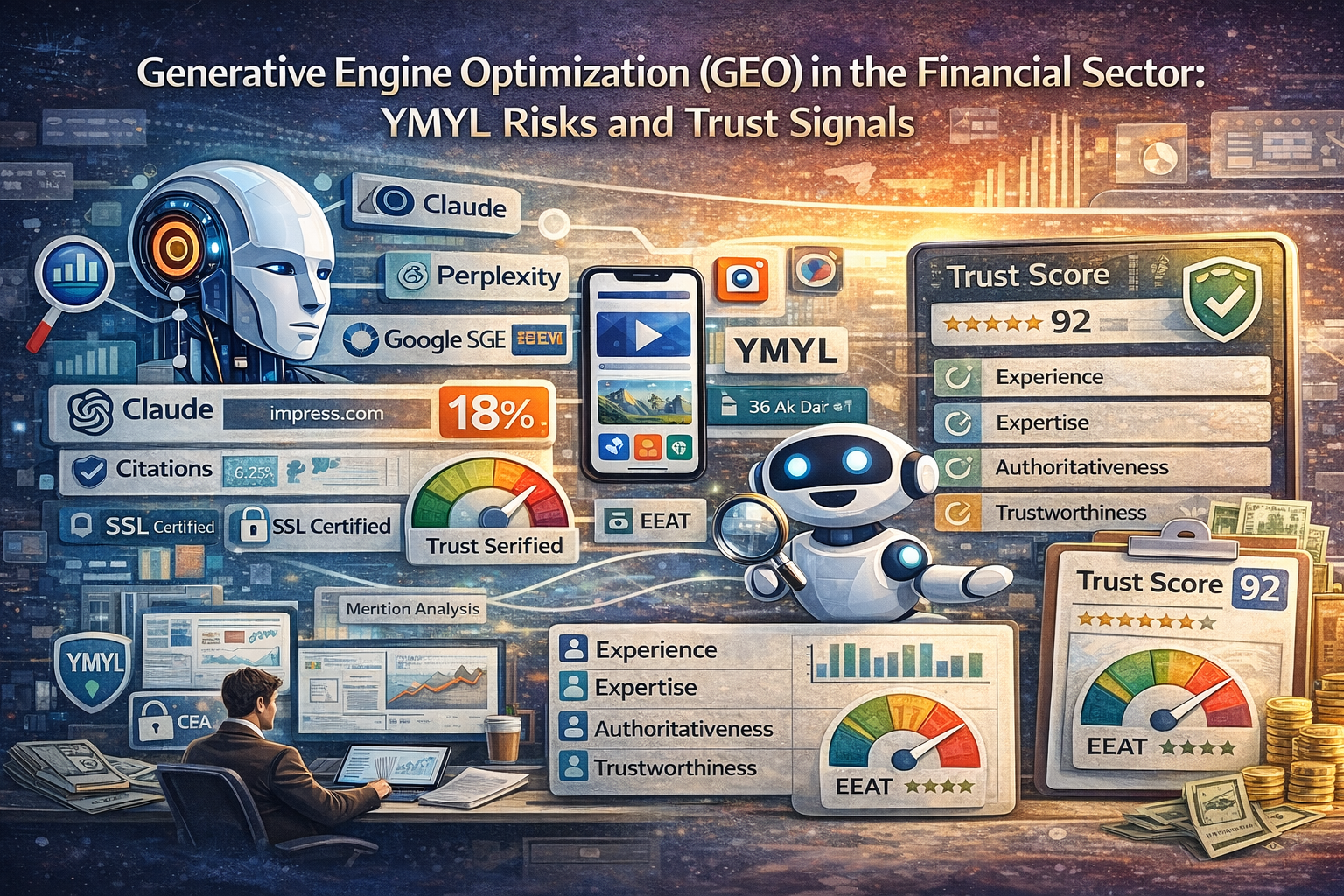

Generative Engine Optimization (GEO) in the Financial Sector: YMYL Risks and Trust Signals

With the integration of artificial intelligence technologies into the search engine ecosystem, the t...

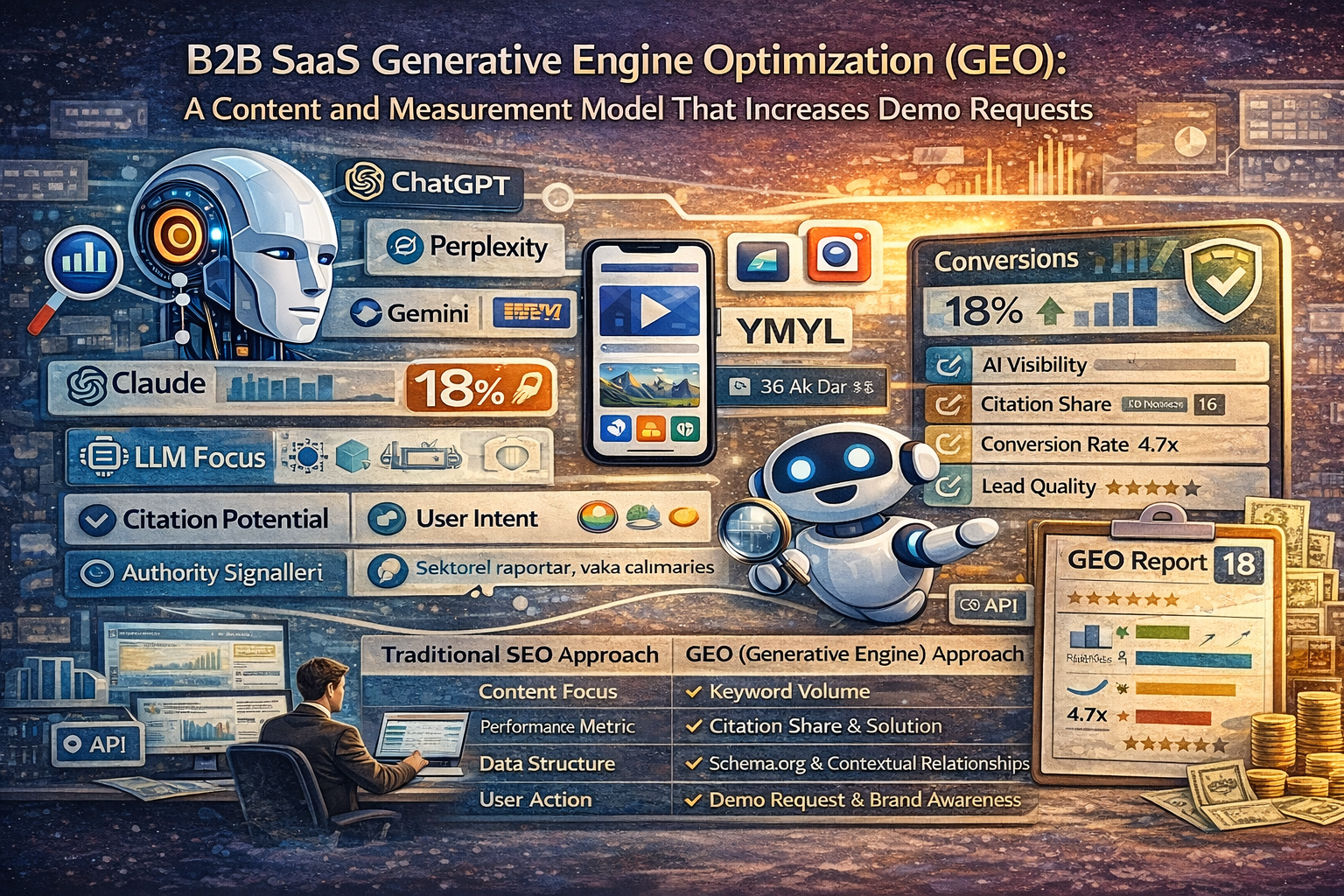

B2B SaaS Generative Engine Optimization (GEO): A Content and Measurement Model That Increases Demo Requests

The digital marketing world is undergoing a major evolution from traditional search engine optimizat...

What Is a Source Term Vector?

A Source Term Vector is a conceptual expertise profile that shows which topics a website is associat...